The Evolution Of Consumer Internet

Over the history of the internet we have seen new distribution and user acquisition channels emerge. With each new channel comes a storm of change in the consumer internet eco-system. Each storm, while it may seem chaotic, follows a similar pattern and cycle. Understanding that cycle, and where your company is within it, can help guide you through the chaos.

New Companies Emerge With New Channels

We have seen a lot of new large distribution channels emerge over the course of the internet. Search (both PPC & SEO), Facebook, and Mobile to name a few. With each new channel we see a set of new companies emerge in various verticals.

Why do we see new companies in each vertical emerge with each new channel?

Two reasons:

1. Cheaper Acquisition - New companies in each vertical initially enter the space with each new channel because it is cheaper to acquire users in the new channel rather than older/existing channels. But if this was the only reason then companies would just spend money on the new channel and new companies would never emerge. Which leads to the second reason..

2. Product <> Distribution Fit - Products are molded to fit with their distribution channels. Incumbents typically have a hard time adapting their product to new distribution channels. In the early days of social gaming on Facebook some casual gaming companies tried to just insert their existing games onto Facebook. That was a failure. Not until they completely redesigned their games from the ground up to fit with the new Distribution channel did they see success.

This typically leaves opportunities for new companies. It also helps explain why distribution channels for the first few years of a consumer product tend to not be diversified, but rather concentrate on one channel only.

Vertical <—> Channel Fit

A vertical doesn’t always fit with a new distribution channel. As we can see above, a new online dating site did not emerge when email invites were the new acquisition method. Online dating users won’t email all their friends to let them know they were on a dating site. The vertical and channel weren’t aligned.

The Fast Follower Advantage

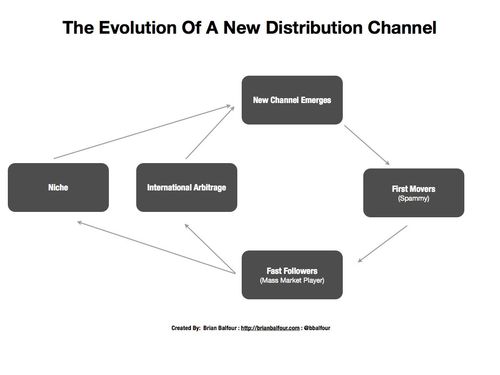

Everyone talks about having first mover advantage. But recent history tells us that it is typically the companies that are fast followers to new distribution channels who end up being the long term winners. When a new channel emerges there tends to be a pattern of how companies evolve in each vertical. Imagine we could zoom in on a cell in my above table. What we would see is a cycle like this:

Here are a couple examples that I will dive further into….

Why does this pattern/cycle exist?

When a new distribution channel first emerges the first movers tend to be companies that I’d label as “spammy.” The company/product is built solely to exploit the new user acquisition channel. When the Facebook platform first emerged, the platform was overwhelmed with gifting, sticker, mob, etc applications. Most were reffered to as “Viral Apps” because they were built for the sole purpose to go viral, not retain users. All are now defunct. User acquisition comes easy to the first movers and they grow very quickly. But the product behind the acquisition machine is an empty experience. Which leaves the door open for the fast followers.

The fast followers to a new distribution channel follow pretty quickly. At this part in the lifecycle of a new channel, there is still an opportunity to take advantage of lower acquisition costs, but competing requires a product that activates or retains users better. If you activate or retain users better, you typically have a lower net CPA and/or higher LTV. As a result you can spend more on acquisition and build a more sustainable business.

Fast followers gain the early benefits of easier acquisition at the top of the funnel, but outlast the first movers because they have a product that retains users better. There tends to be a few large second movers, with one long term winner. In social gaming it was Zynga, Playdom, Crowdstar. Zynga won. In social networking it was Facebook and Myspace. Facebook won.

The Shift To Niche & International Audiences

Once there are a couple companies that are fighting for the mass market, others realize they can’t compete at the acquisition layer of the marketing funnel. They are forced to find an advantage deeper in the marketing funnel. [enter marketing funnel graphic] This causes two types of companies to emerge. Those that target a niche audience, and those that use international arbitrage.

Lets use the evolution of social networking as example:

After Facebook emerged as the dominant social networking player in the US, other companies in the social networking space realized they couldn’t compete. In the US we quickly saw social networks that targeted niche audiences emerge. BlackPlanet.com (social network for African Americans), Dogster (social network for pet owners), FanIQ now defunct (social network for sports fans), CafeMom (social network for moms) are just a few examples.

By focusing on niche audiences, companies gain advantages at multiple pieces of the marketing funnel. Companies that have focused audiences tend to be able to monetize higher on a per user basis. They activate and retain users for their target audience because they can build a more specific experience designed for their target audience.

At the same time as niche social networks launched, so did international arbitrage players. VZnet (social network for Germany), Tuenti (social network for Spain), VK.ru (social network for Russia), NK.pl (social network for Poland) are a few of the many examples. For similar reasons to companies that focus on niche audiences, international players gain advantages in the marketing funnel.

These advantages in the marketing funnel once again lower CPA’s and increase LTV for their target audience. As a result, they can outspend (if needed) the mass market fast followers for their target audience.

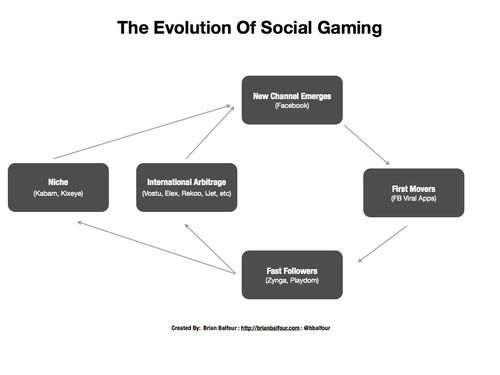

Here is another example of this cycle in Social Gaming:

As Zynga emerged as the dominant mass market social gaming player, niche players emerged. Primarily Kabam and Kixeye who focused on the “mid core” gaming audience. They built games specifically for that audience and as a result activated, retained, and monetized users in that audience a lot better than Zynga. For the mid-core audience, they were then able to outspend Zynga and any other mass market player.

In addition, international players emerged. Vostu (Brazil), Wooga (Germany), Rekoo (China), and many more.

IMPORTANT: Cycle Time Is Accelerating

If there is one takeaway from this post, it is that the time for the above cycle to complete is accelerating. I think this is due to a few reasons:

1. Less Capital Needed

The amount of money and time required to get consumer internet product out to the market has decreased in cost. This means competition can enter the market quicker which accelerates the cycle.

2. Information Flow

The flow of information and data around user acquisition tactics is increasing. There is a whole market of tools (SEOmoz, WhatRunsWhere.com, MixRank.com, AppData, etc) designed so that you can uncover and reverse engineer competitors (or any company’s) user acquisition methods. Additionally, sites like Quora contain a gold mine of information that was much harder to access previously. The increase in information flow means new user acquisition methods and tactics can be uncovered and learned quicker.

3. International Is Becoming Easier

Going international isn’t easy, yet. But it is definitely becoming easier. There are now methods to do language translation cost effectively and fast. Single platforms like Facebook and iOS also provide easier access to international audiences. Funding in international markets is becoming more available. Barriers still remain, but they are breaking down. As they break down, the latter half of the cycle accelerates.

This means as an entrepreneur or an incumbent company you need to act extremely fast. Specifically for new companies, speed and focus are your friend.

Established Companies Are Notoriously Bad At Taking Advantage Of New Channels

Established companies in a vertical have a very difficult time evolving into a new channel. As a result the new companies that emerge typically eat away at the older established players. Why are established players so bad at evolving into a new channel?

1. Risk Profile

At the earliest stages of a new channel, it is hard to tell whether or not that channel is going to be substantial enough to be worth the investment. People doubted Facebook for years. In social gaming it took a couple years before any previously existing major game company put significant resources behind the platform. New channels are inherently risky to try and go after. Startups are in a much better position to take these risks. As a result they tend to be the first and second movers to a new channel.

2. Startup Constraints

Most startups don’t have the resources and funds to compete in an established channel with similar tactics. This constraint leads them to search for a new channel because it is the only way they can grow cost effectively.

3. Product <> Channel Fit

Established companies tend to rely on the knowledge they have accrued with their existing channel. Leveraging a completely new channel requires new knowledge, skills, and a change in the product experience.

What’s Next?

The cycle for mobile is not over. We are going to see a lot of new entrants and evolutions in all of the consumer categories. More interesting (at least IMO) is asking the question, what is the next channel? Join my email list to hear about the new channels I'm experimenting with.

Comments